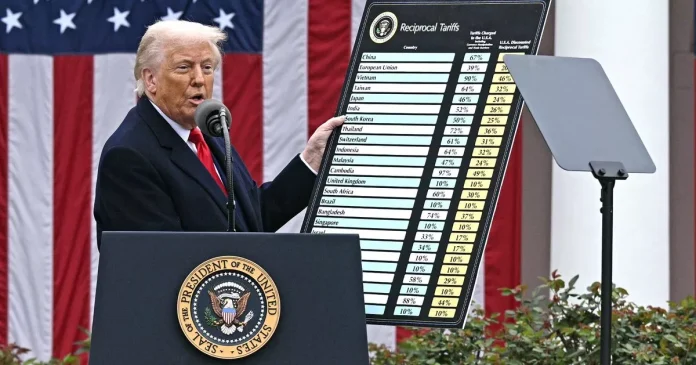

UK savers could see rates drop in the wake of Donald Trump’s global tariffs war, according to a personal finance expert – but investors are being urged not to make “knee-jerk” decisions. The US President sparked chaos in stock markets after he announced his “Liberation Day” levies last month.

But in a surprise U-turn last night, President Trump announced a 90-day pause with a universal 10% tariffs on all countries – except for China, which has now been slapped with 125% tariffs as a trade war between Washington and Beijing deepens. Asian and European markets rebounded following news of the pause.

This week, we’ve also seen mortgage lenders start to lower rates over expectations that UK interest rates could be cut again next month. The reductions are down to lower interest rate swaps, which move in line with expected changes to the Bank of England base rate.

While lower interest rates are good news for mortgage borrowers, it means the rates applied to savings accounts could drop. Myron Jobson, senior personal finance analyst at Interactive Investor, said: “The market is now predicting that interest rates will fall more quickly than previously anticipated as policymakers move to shield the stuttering UK economy from a potential downturn – a risk exacerbated by Trump’s tariff wars.

“While lower borrowing costs might come as a relief to mortgage holders, they could spell bad news for savers, who have only just started to see decent returns on their cash after years in the doldrums.”

However, some economists have warned that the tariffs could push up prices, which would add to inflation and could further interest rate cuts less likely. Mr Jobson continued: “A great deal of uncertainty still clouds the outlook for UK investors and savers. Stock market swings – both upward and downward – are all part of market volatility, which can be unsettling but is a natural feature of investing.

WHATSAPP GROUP: Get money news and top deals straight to your phone by joining our Money WhatsApp group here. We also treat our community members to special offers, promotions, and adverts from us and our partners. If you don’t like our community, you can check out any time you like. If you’re curious, you can read our Privacy Notice.

NEWSLETTER: Or sign up to the Mirror’s Money newsletter here for all the best advice and shopping deals straight to your inbox.

“Investors should continue to avoid making knee-jerk decisions based on short-term noise and focus instead on their long-term financial goals. Maintaining a well-diversified portfolio across different asset classes, sectors, and geographies is key to weathering market turbulence. It’s also a good time to review investment strategies to ensure they remain aligned with your risk tolerance and time horizon.“

It comes after the Bank of England warned of increased risks to global financial stability and economic growth, following President Trump’s tariffs. A report by its Financial Policy Committee (FPC) found: “The global risk environment has deteriorated and uncertainty has intensified. The probability of adverse events, and the potential severity of their impact, have risen.”

These risks are “particularly relevant” to the UK because it is an open economy with a large financial sector. But the report found UK household borrowers, like people with a mortgage, and businesses with loans have remained resilient on the whole. However, some companies – such as those that are backed by private equity – are more vulnerable to global developments.

The committee said: “A major shift in the nature and predictability of global trading arrangements could harm financial stability by depressing growth.”

It also warned that growing geopolitical tensions heighten the risk of cyber-attacks, which could disrupt the supply of financial services to UK households and businesses.

At Reach and across our entities we and our partners use information collected through cookies and other identifiers from your device to improve experience on our site, analyse how it is used and to show personalised advertising. You can opt out of the sale or sharing of your data, at any time clicking the “Do Not Sell or Share my Data” button at the bottom of the webpage. Please note that your preferences are browser specific. Use of our website and any of our services represents your acceptance of the use of cookies and consent to the practices described in our Privacy Notice and Cookie Notice.