Premium Bond savers have been warned of further cuts to its prize fund rate. The prize fund rate – which is the closest thing Premium Bonds has to an interest rate – is being reduced from 4.00% to 3.80% from the April 2025 draw.

NS&I, the state-backed savings bank which runs Premium Bonds, has a net financing target of £9billion for the current financial year, with a margin of plus or minus £4billion – but the Spring Statement confirmed this will increase to £12billion, with a margin of plus or minus £4billion, for the 2025/26 financial year.

Net financing takes into account money coming in, including deposits and interest, minus money going out from withdrawals and interest or Premium Bonds prize draw payments. The total it has raised so far across the first three-quarters of this year is £8.9billion.

Sarah Coles, head of personal finance at Hargreaves Lansdown, said: “Premium Bond woes may continue even after the NS&I fundraising target increases. NS&I had a massive third quarter, delivering £5.5 billion, which explains the raft of recent rate cuts. It meant the organisation had almost entirely filled its boots for the current tax year, when it had three months left to run.

“We’re yet to get the latest of these cuts – the Premium Bond prize cut set for April – when it falls from 4% to 3.8%. The question for many savers is whether this will be the last. On the one hand, the fundraising target will rise to £12 billion. On the other, we’re expecting savings rates to fall across the market, and the prize rate is likely to fall in step with it.

“The rush into NS&I in the third quarter shows how much pent-up demand there is. As wages rise ahead of inflation, more people are finding money to put away for the future. The HL Savings & Resilience Barometer shows that on average we’re saving 5.5% of income, which is a fair chunk of cash looking for a home.

“It means NS&I needs to be careful that Premium Bond don’t fall behind the rest of the market in the slow march towards lower rates. Sadly for bond holders, it means this is unlikely to be the last of the cuts to the prize rate.”

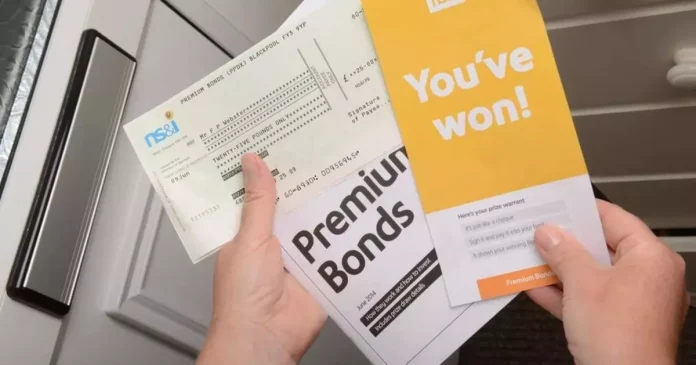

Premium Bonds are a savings product, but instead of getting a guaranteed rate of interest, you’re entered into a monthly prize draw. The smallest prize you can win is £25 and the biggest prize is £1million. But winning isn’t guaranteed, and some months, you may not win anything at all.

The prize fund rate is the closest thing Premium Bonds has to an interest rate. The odds of winning a prize from the April 2025 draw will remain at 22,000 to 1. There is expected to be over £411million in the prize fund with over 5.9 million prizes available, ranging from two £1million prizes to over 2.1 million £25 prizes.

WHATSAPP GROUP: Get money news and top deals straight to your phone by joining our Money WhatsApp group here. We also treat our community members to special offers, promotions, and adverts from us and our partners. If you don’t like our community, you can check out any time you like. If you’re curious, you can read our Privacy Notice.

NEWSLETTER: Or sign up to the Mirror’s Money newsletter here for all the best advice and shopping deals straight to your inbox.

You can use the NS&I online prize checker tool, or the Premium Bonds prize checker app, to see if you’ve won. If you’re a winner, you can have the money paid into their bank account, or reinvest it into new Premium Bonds. You should be emailed or sent a text message from NS&I if you’ve won.

The odds of a bond winning each month are 21,000 to 1 for every £1 bond – but as we’ve mentioned above, most prizes are for smaller amounts. NS&I reduced its prize rate from 4.65% to 4.40% from its March 2024 draw. However, there will still be two jackpot prizes of £1million. The prize fund rate is often described as the the nearest thing Premium Bonds has to an interest rate.

At Reach and across our entities we and our partners use information collected through cookies and other identifiers from your device to improve experience on our site, analyse how it is used and to show personalised advertising. You can opt out of the sale or sharing of your data, at any time clicking the “Do Not Sell or Share my Data” button at the bottom of the webpage. Please note that your preferences are browser specific. Use of our website and any of our services represents your acceptance of the use of cookies and consent to the practices described in our Privacy Notice and Cookie Notice.