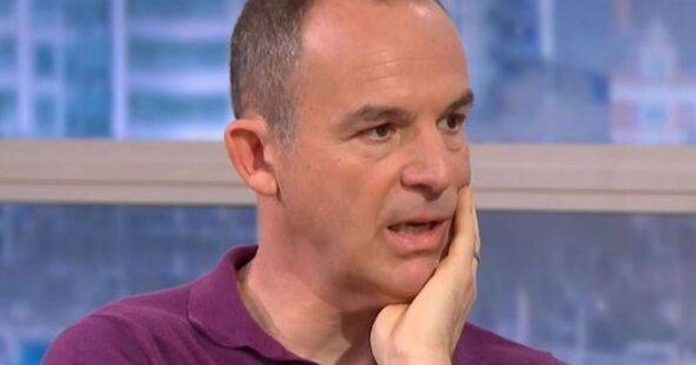

Martin Lewis has explained how people aged 20 to 25 can get a free four-year railcard worth £100 through the high street bank Santander. To get the freebie, you need to open any Santander savings account or cash ISA.

You must pay in at least £50 by May 31, 2025, and keep a minimum balance of £50 until at least June 30, 2025. You must also set up online banking with Santander by May 31, 2025.

Once you have met this criteria, you will be sent a code through an online or mobile banking message, which you’ll need to use to redeem your railcard. You will have until June 30, 2025 to use your railcard code.

The freebie is for a 16 to 25 railcard, which gives you a third off rail travel and normally costs £80 for a three-year railcard, or £35 for one year. The offer isn’t limited to new customers – existing and previous customers can also get it.

In a new video posted to social media, Martin Lewis said: “You can do this as long as you’re a UK resident and Santander hasn’t given you the railcard freebie before, which it only would have done if you had the Santander student bank account. This isn’t just for students though. This is for anyone aged 20 to 25.”

Martin recommended several Santander accounts. If you’re opening a Santander account just to get the railcard, the MoneySavingExpert.com founder recommended putting your £50 into its 1.2% easy-access saver.

But if you actually want to save with Santander, Martin said its best standard account is its one-year fixed cash ISA that pays 4.25% – however, you need a minimum £500 to open this account. There is also the Edge Saver account that pays 6% interest on up to £4,000.

WHATSAPP GROUP: Get money news and top deals straight to your phone by joining our Money WhatsApp group here. We also treat our community members to special offers, promotions, and adverts from us and our partners. If you don’t like our community, you can check out any time you like. If you’re curious, you can read our Privacy Notice.

NEWSLETTER: Or sign up to the Mirror’s Money newsletter here for all the best advice and shopping deals straight to your inbox.

Martin added: “To get that, you need to open or have its ‘Santander Edge’ current account, which is a top bank account for those who pay bills. You pay it £3 a month, it gives you 1% cashback on all bills you pay from it by Direct Debit up to £10 a month, and you also get cashback on your grocery or fuel or other transport spending in the UK, up to £10 a month.

“Again, it’s 1% of that spending. So it’s a good cashback account, but is a bit more of a hassle if you actually wanted to open the bank account.”

Saket Jasoria, Head of Savings at Santander UK, said: “With the Easter and Spring Bank Holidays on the horizon, many people will be saving up for a quick getaway – whether that’s a weekend trip to see friends and family, or just making the most of the opportunity to explore somewhere new.

“We’re delighted to be able to help them make the most of the upcoming holidays, as well as supporting them to save even more over the years ahead, with both the railcard and through our range of savings products.”

At Reach and across our entities we and our partners use information collected through cookies and other identifiers from your device to improve experience on our site, analyse how it is used and to show personalised advertising. You can opt out of the sale or sharing of your data, at any time clicking the “Do Not Sell or Share my Data” button at the bottom of the webpage. Please note that your preferences are browser specific. Use of our website and any of our services represents your acceptance of the use of cookies and consent to the practices described in our Privacy Notice and Cookie Notice.